I never talk much about my journey to become financially independent (FI) to others. Although my family do know about my journey. I never gave anyone advice about investing or living below their means. The reason I don’t talk much about my journey is that I have the feeling most people don’t understand, or don’t want to understand the principles of FI.

I never talk much about my journey to become financially independent (FI) to others. Although my family do know about my journey. I never gave anyone advice about investing or living below their means. The reason I don’t talk much about my journey is that I have the feeling most people don’t understand, or don’t want to understand the principles of FI.

Recently my brother phoned me. A few months ago he graduated from university and recently he got a job offer with a nice salary. The pay check is large enough to save and invest a significant percentage of his income in stocks. On the phone he asked me for advice.

Here are the 3 golden rules to become financially independent (FI):

- Start investing early, preferably directly after starting your first job. Compounding interest is the big power behind a big portfolio.

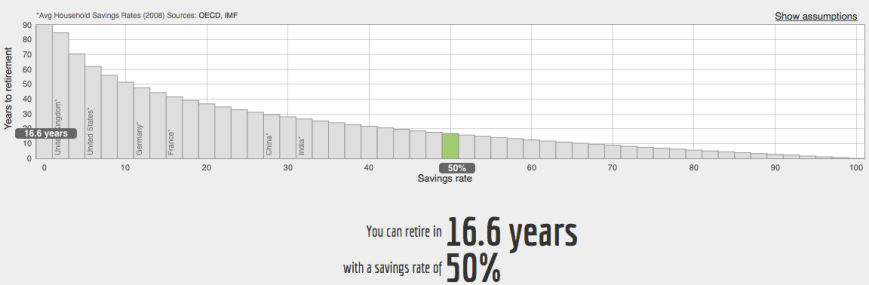

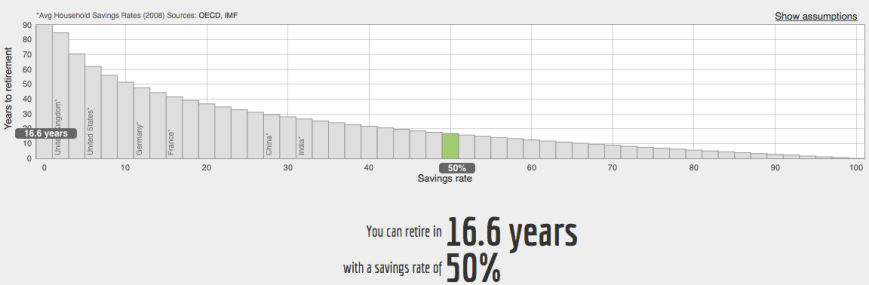

- The most important metric in becoming FI is your savings rate, not your income. If you have a savings rate of 50%, you are FI in 16.6 years (read the shockingly simple math behind FI). If you save and invest 25 x your annual expenses, you are FI. Living frugal or below your means, makes your savings rate higher, and your required portfolio worth lower.

Put here your variables and check your FI date.

3. Invest regularly (monthly) in the stock market, there are 2 options to invest for FI:

- Option 1 (for those interested in the stock markets) is to invest directly in (dividend) stocks. Like me. After years of investing you can live of the (growing) dividends.

- Option 2 (for everyone else) is to invest in low-fee index-funds, for example like Amanda and Travis.

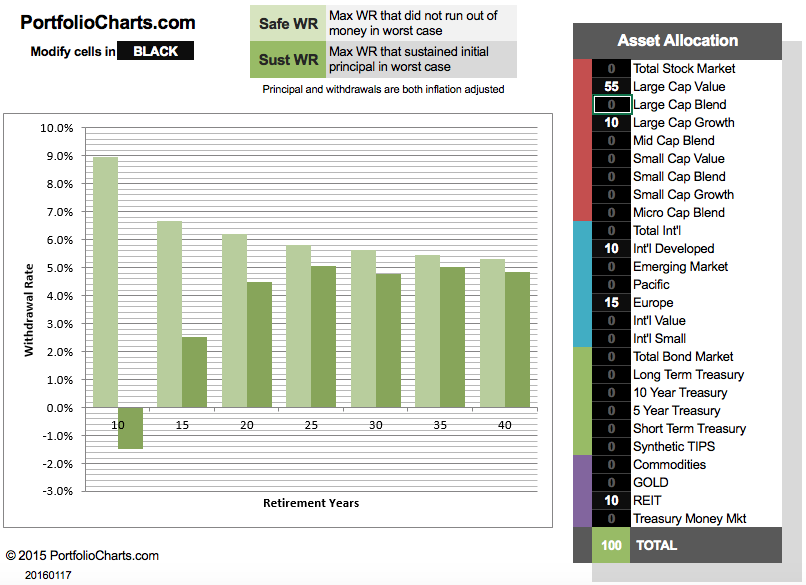

For golden rule number 1 and 2 you can read some background in the links provided. For the 3rd golden rule, there some discussion in the FI community. My view is this: If you are interested in the stock market, and like to follow it closely, you should buy a diversified portfolio with dividend stocks.

If you don’t want to follow the stock market closely you’d better buy low fee index funds. Here I will point out some pro’s and contra’s about the index funds.

Pro’s of the index funds

- You directly buy a diversified portfolio

- You don’t have to do the research which stocks to buy

- The index funds have low fees

Contra’s of the index funds

- You have to pay those low fees every year till the end of time

- It’s more likely the index fund will cut the dividend in hard times, compared to your portfolio with dividend stocks

- When you are FI, every year/month you sell a small part of your portfolio to pay your monthly expenses. You also have to sell your stocks after a big dip or crash on the stock markets.

Low fee index funds

After you made the decision to buy a low fee index fund, you have to pick the right fund. I suggest Vanguard low fee index funds, because they are one of the biggest, cheapest and maybe safest. I further suggest an index fund covering stocks from all over the world (especially when you are an European investor). Examples are VT (Vanguard Total World Stock ETF, expense ratio 0,14%), or a combination with VXUS and VTI (Vanguard Total International Stock ETF, expense ratio 0,13%; and Vanguard Total Stock Market ETF, expense ratio 0,05%).

Conclusion

When you are interested in the stock market and are willing to spend enough time analyzing stocks, then option 1 (investing in dividend stocks) is best to become FI. When you are just starting your journey or don’t have the time or the interest in the stock market to analyze stocks, then it is better to buy low fee index funds.

What advice did I give my brother?

It is important to know that he is not following the stock market like I do. Therefore I gave him the advice to buy low fee index funds. While doing it this way, he immediately buys a diversified portfolio. After some time, when he is getting more and more in the stock market he can switch to option 1, investing in dividend stocks.

I never talk much about my journey to become financially independent (FI) to others. Although my family do know about my journey. I never gave anyone advice about investing or living below their means. The reason I don’t talk much about my journey is that I have the feeling most people don’t understand, or don’t want to understand the principles of FI.

I never talk much about my journey to become financially independent (FI) to others. Although my family do know about my journey. I never gave anyone advice about investing or living below their means. The reason I don’t talk much about my journey is that I have the feeling most people don’t understand, or don’t want to understand the principles of FI.

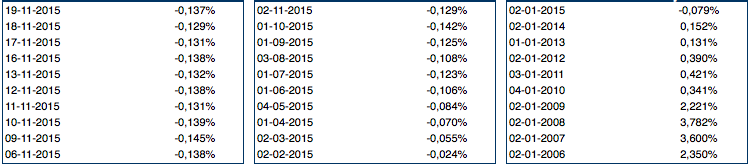

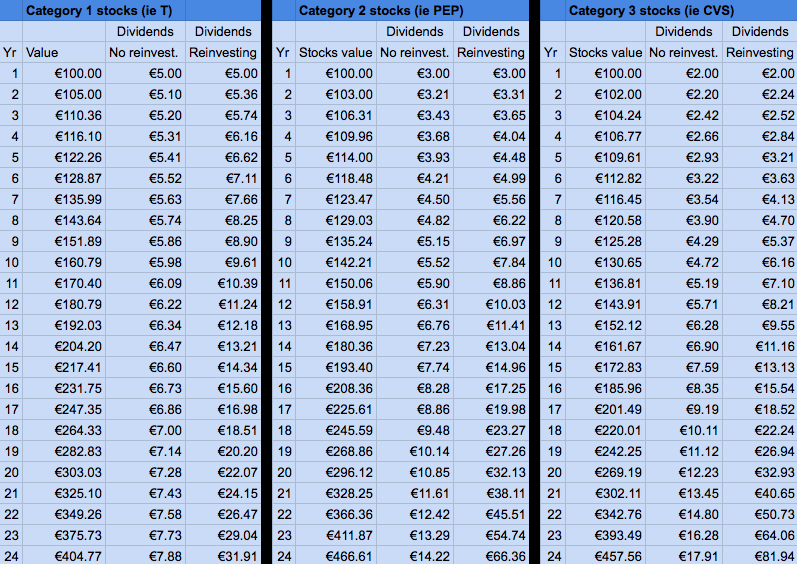

When buying stocks for my dividend portfolio I want to make sure that I buy the right stocks. The right stocks mean to me, stocks that provide safe dividends when I’m retired. The purpose of my dividend portfolio is to live of the dividends and not selling the stocks.

When buying stocks for my dividend portfolio I want to make sure that I buy the right stocks. The right stocks mean to me, stocks that provide safe dividends when I’m retired. The purpose of my dividend portfolio is to live of the dividends and not selling the stocks.

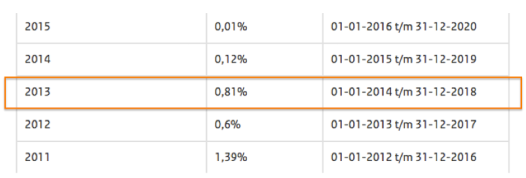

In the Netherlands we have a special “wealth tax”, every year you have to pay 1.2% of your total portfolio worth. Crazy!! But as I have written before, there are a lot of benefits living in the Netherlands.

In the Netherlands we have a special “wealth tax”, every year you have to pay 1.2% of your total portfolio worth. Crazy!! But as I have written before, there are a lot of benefits living in the Netherlands.